Real Estate Vs. Stocks: What 145 Years Of Returns Tells Us

Over 145 years, stocks and real estate performed well. But is one better than the other?

Updated on March 10, 2023.

Let’s get one thing straight: everyone should hold both stocks and real estate in their portfolios. Diversification is the ultimate hedge against risk.

But that doesn’t mean we can’t pit stocks and real estate against each other in a classic Mortal Kombat-style matchup. Which earns the best return on investment: real estate or stocks? And while we’re asking this grandiose question, which investment is safer?

The Latest Data

There’s a sweeping study done by several U.S. and German universities and the German central bank that analyzed data from 16 countries over a 145-year period. It’s a fascinating study, and we’ll get to it in a moment. But it comes with a downside: it only includes data through 2015.

So before we dive into the best data, let’s look at more recent — but less comprehensive — data.

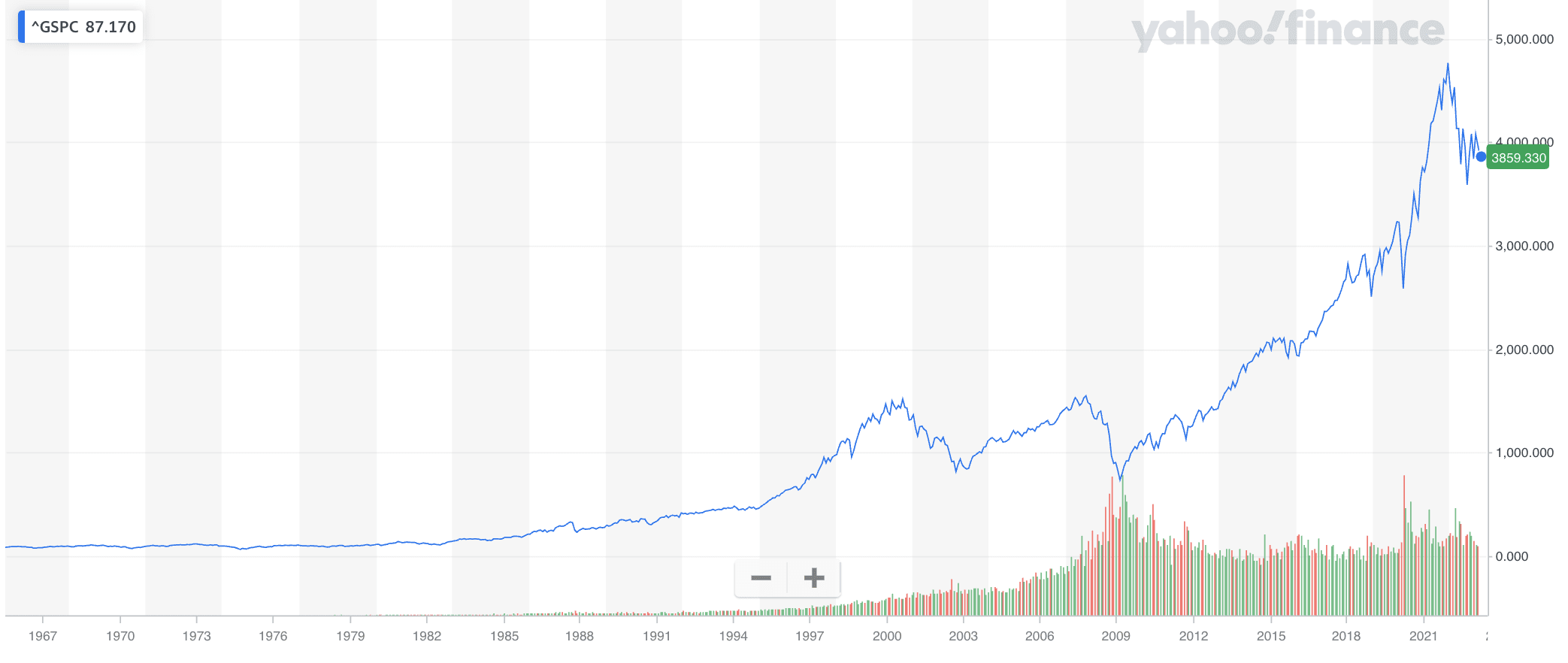

Stock market performance

Fortunately, it’s easy to find clear stock market data.

Over the 45 years from January 1978 through December 2022, S&P 500 averaged an impressive 11.53% return. That includes both dividend income and price gains.

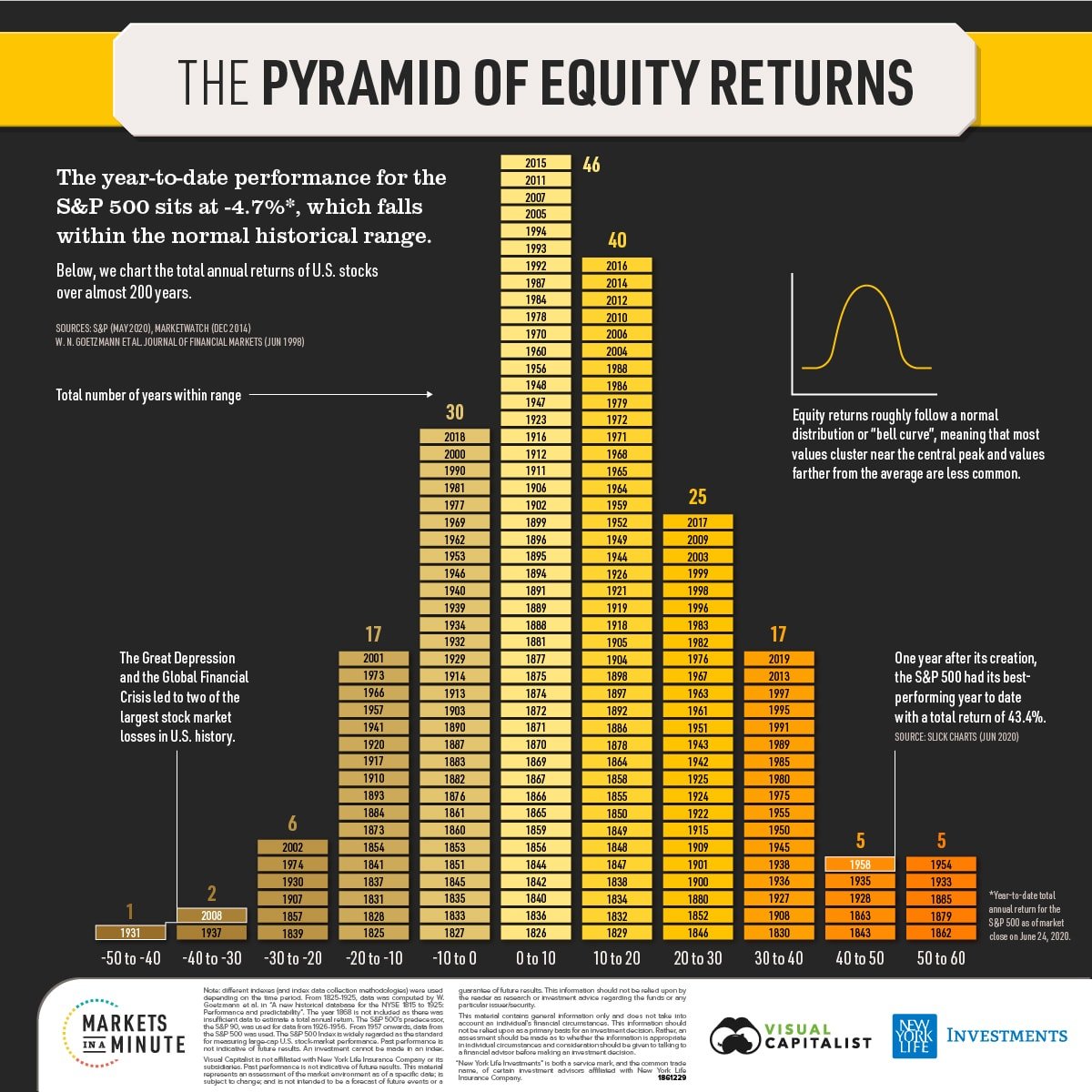

But less impressive is the volatility in the stock market. Take a look for yourself:

More on volatility later, but it marks one of the primary risk factors in any investment.

For reference, Treasury bills returned an average of 4.3% during that time period.

Commercial real estate performance

The National Council of Real Estate Investment Fiduciaries (NCREIF) compiles the best data on real estate investments in the U.S., going back to 1977. Their data includes over 35,000 privately-owned commercial properties (from office buildings to apartment complexes to industrial and beyond), plus over 150 open- and closed-end funds owning real estate.

Over that same 45-year period from January 1978 through December 2022, the NCREIF Property Index (NPI) has averaged an annual return of 9.03%. For additional context, the NAREIT all equity index of publicly-traded U.S. REITs averaged 11.58% in that time.

As with the S&P 500 return documented above, those index returns include both income and appreciation.

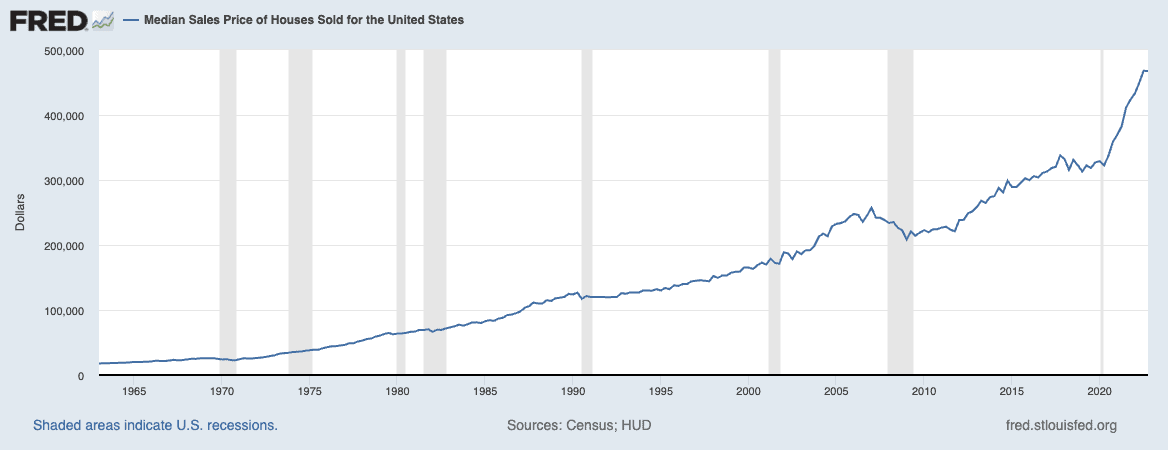

So how does residential real estate measure up?

Residential real estate performance

The data is less clear for residential real estate. A report from Real Estate Witch found that home prices have increased 7.6 times faster than income since 1965, showcasing just how well residential properties have performed in recent decades.

But residential real estate returns include rental income, not just price growth. Unfortunately, there are precious few reliable resources that include both income and appreciation.

Fractional rental investing platform Arrived did a 20-year study in late 2021 that found that residential U.S. real estate returned an average of 11.7% — sort of. They included financing when running those numbers, which distorted the total return to look higher. Removing leverage, that number drops to 9.5%.

Sources citing Standard & Poor’s claim that residential real estate averages a return of 10.6% over time, but I couldn’t find the original data to verify that or even determine what time frame that figure refers to.

You can see why the 145-year study is so valuable, given how unreliable other data on residential real estate returns is.

As a final thought, compare the stability in home prices to the volatility of stock prices:

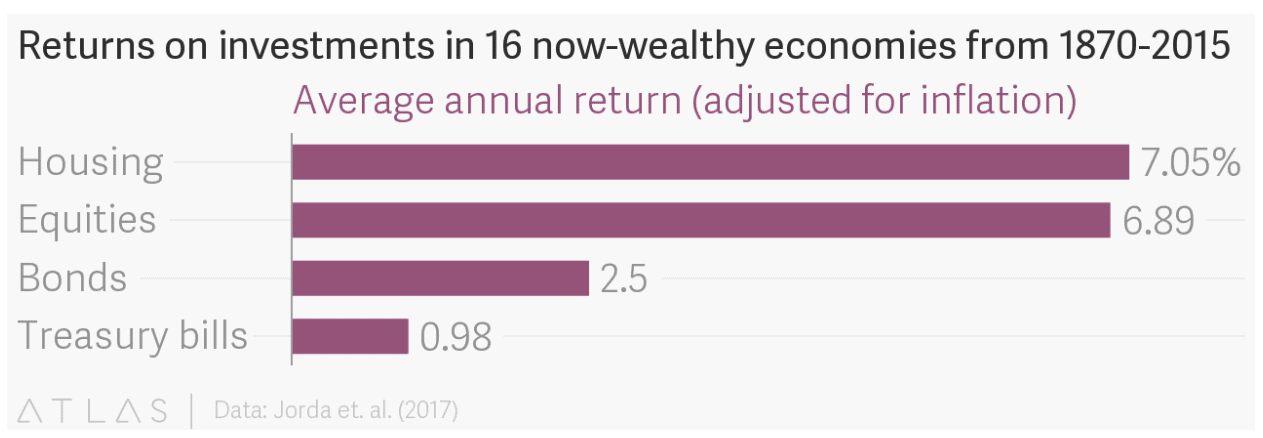

The 145-Year Study

A team of economists from the University of California, Davis, the University of Bonn, and the German central bank set out to answer these questions by analyzing a stunning amount of data collected over a 145-year period of time.

The lead authors of the study — Oscar Jorda, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan M. Taylor — reported the findings of their massive study in a paper entitled “The Rate of Return on Everything, 1870-2015.” In it, researchers looked at 16 advanced economies over the past 145 years to find what offers the best return on investment. They compared returns on several asset classes, including equities, residential real estate, short-term treasury bills, and longer-term treasury bonds.

To better compare apples to apples, with each asset type, they adjusted for inflation and included all returns, not just appreciation. Dividend income was included for equities, and rental income was included for residential real estate.

Their findings, in short: Residential real estate was the better investment, averaging over seven percent per annum. Equities weren’t far behind, at just under seven percent.

Then came bonds and bills with a far lower rate of return, surprising no one.

Real Estate vs. Stocks: Average ROI

Rental income proved an important factor — roughly half of the returns on real estate investments came from rental income, while the other half came from appreciation.

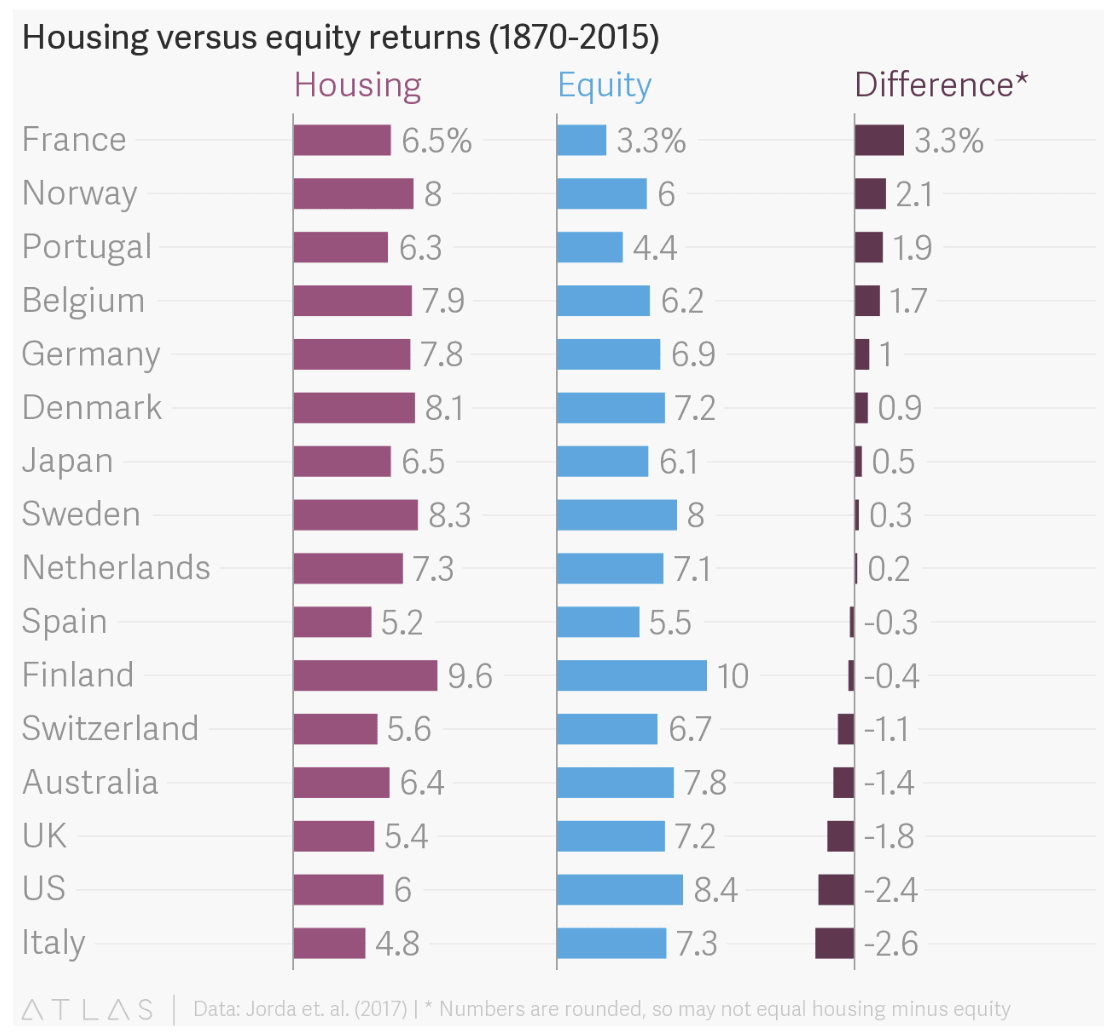

Stock investments and investment property each performed differently in various countries, of course. Here’s a comparison of each of the 16 countries:

Keep in mind that these are long-term return averages over the course of many decades. In real time, these returns bounced up, down, sideways, and in circles.

Here’s a curious little chestnut for you: From 1980 to 2015, the stock market, on average, performed significantly better than real estate investments. Across the 16 countries studied, stock investments earned an average annual rate of return of 10.7 percent, decisively beating the real estate market’s stolid 6.4 percent.

Should we all sell our rental property and move our money into a Vanguard account?

Of course not. But the reasons are multiple and a bit nuanced.

First, a few outlier countries threw off the average return on investment from the time period between 1980 and 2015. Japan saw its real estate markets collapse as its population aged. And in Germany, residential real estate has been stuck in the slow lane for decades.

Meanwhile, stock investments in Scandinavia have exploded.

But the most interesting case for real estate investing lies in its risk-reward ratio.

Risk by Asset Class

Let’s do a quick stereotype check-in, shall we?

Treasury bonds are low-risk, low-return. I don’t think anyone’s prepared to challenge that stereotype, which exists for a reason.

Stock investments are high-risk, high-return. This one gets a little more interesting, but a quick look at how stock markets have gyrated for the last century — up 29 percent one year and down 18 percent the next — should disabuse anyone of the notion that stock investing doesn’t come with high volatility and risk.

And that brings us to an economic assumption that dates back to, well, the beginning of economic theory. Economists have long held as a given that risk and returns are highly correlated and that “the invisible hand” of the market will ensure that remains the case.

Why? Because if an asset were low-risk, high-return, everyone and their mother would fling so much money at it that the rate of return would dry up faster than Lindsay Lohan’s acting career.

Except, that assumption hasn’t held true for residential rental properties.

Rental properties: low-risk, high-return

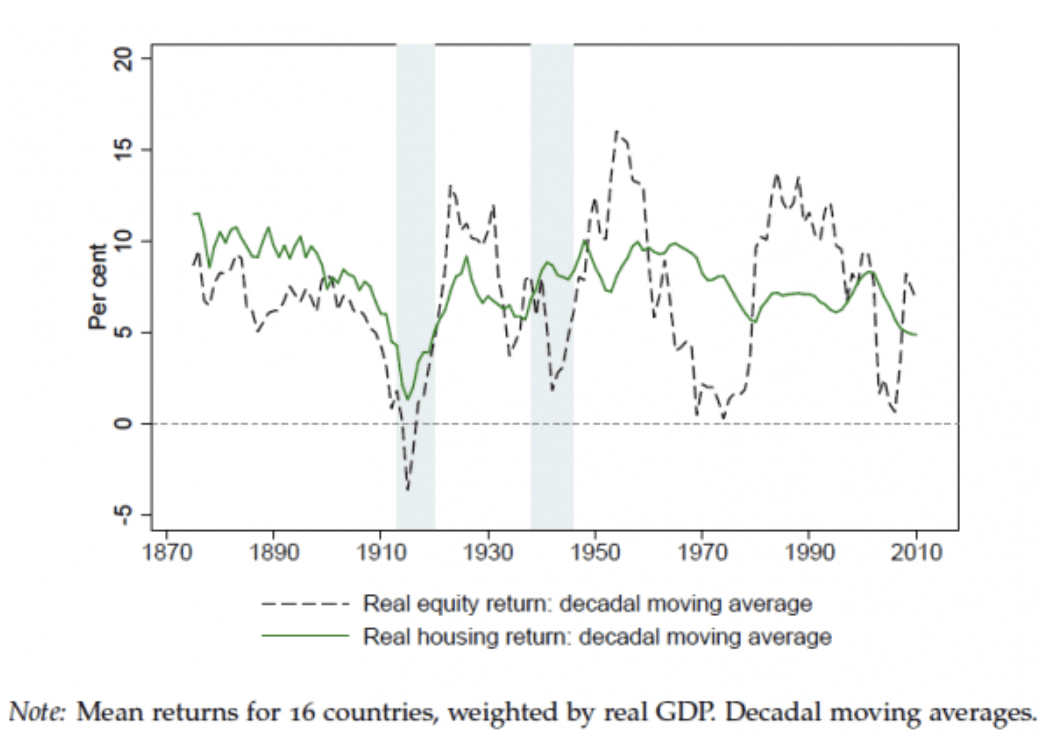

Throughout modern history, residential real estate investors may actually boast the best return on investment, thanks to its extremely high rate of return with low risk. Take a look at volatility for real estate versus stock for the past 145 years:

To begin with, real estate is also notoriously illiquid. You can’t buy it and sell it on a whim — either process typically takes months.

Second, real estate investing is expensive. Until the past 15 years, with the advent of crowdfunding, you couldn’t invest your extra $100 a month to buy an investment property.

Even if you leverage to the hilt and borrow the maximum mortgage allowed at a low-interest rate, that still usually puts you at a 20% down payment, plus thousands of dollars in closing costs, which says nothing of credit requirements, income requirements, and/or lenders’ requirements for investing experience.

In other words, real estate investing has a high barrier to entry.

It’s also difficult to diversify your investment portfolio for those very same reasons. If each asset requires $20-100K in cash to purchase, then it takes a lot of money to build a broad, diverse real estate portfolio.

Rental properties also come with risks from tenants. Tenants could damage your property or default on rent. But you can manage these risks through aggressive tenant screening and insurance policies (including rent default insurance).

You can also manage risk by choosing your locations and investing niche with care. For example, imagine you invest in student housing in college towns. You could choose college towns with both affordable real estate and massive demand for off-campus housing. A study by Porch.com found that Rhode Island, Maine, and Illinois boast the most savings for college students living off-campus, creating a huge demand for off-campus student housing. In these states, off-campus housing prices are 37%, 26%, and 25% lower than on-campus housing, respectively. (Check out Providence, Rhode Island, for a particularly good example.)

Finally, rental properties offer fantastic tax breaks. If you live in the property and house hack, you can write off mortgage interest and exclude up to $500,000 of net gains through the Section 121 exclusion. You can also deduct depreciation on your investment portfolio, use 1031 exchanges to defer taxes on the sale of any rental-only properties, and a dozen other tax perks besides.

Measuring Risk vs. Return

How do you measure an investment’s risk against its rate of return?

It turns out there’s a simple way to determine the best return on investment: a literal risk-reward ratio. It’s called the Sharpe ratio after its creator, William Sharpe.

You start with an asset’s return and subtract out the return of a short-term, risk-free alternative (like U.S. Treasury bills). That gives you a “risk premium” — the extra return the asset delivers over a risk-free investment.

Then you simply divide that “risk premium” over the asset’s volatility, as measured by its annual standard deviation in value:

Risk premium / average annual standard deviation

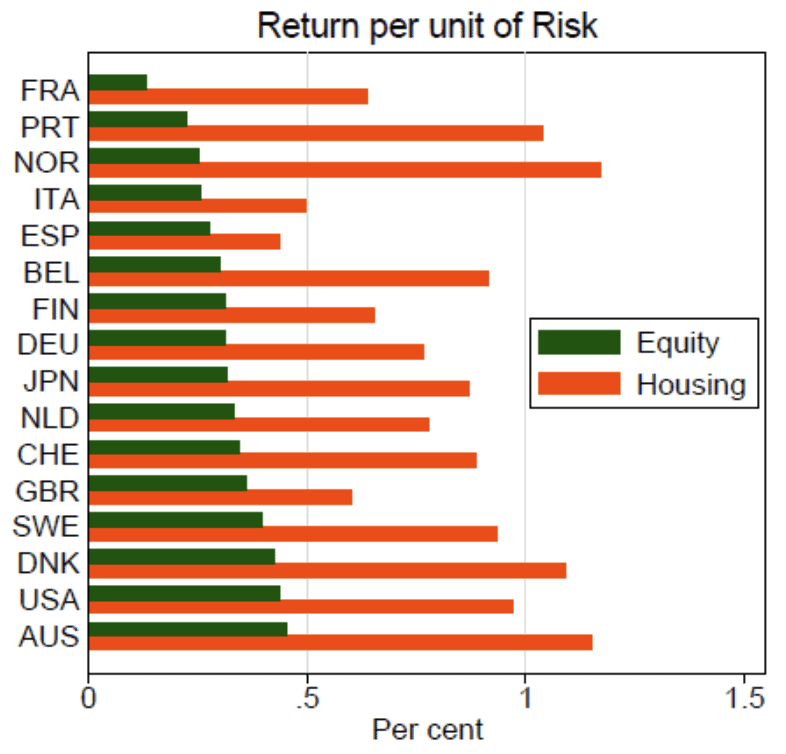

If the math gives you a headache, don’t worry about it. Just think of it as return divided by risk. A higher ratio indicates a better investment — greater return on investment relative to the risk. Here’s the breakdown:

- Treasury bonds: Their Sharpe ratio of around 0.2 is weak sauce.

- Stock investments: Not much better, at 0.27. Sure, their returns were strong, but they’re more volatile than plutonium in a mad scientist’s lab.

- Residential real estate: The average Sharpe ratio of 0.7 is great.

The Sharpe ratio for real estate has only grown stronger over time. Since 1950, the Sharp ratio for real estate has averaged an impressive 0.8.

Another way of looking at it is return per unit of risk — here’s how stock investments have compared to real estate in each of the 16 countries studied:

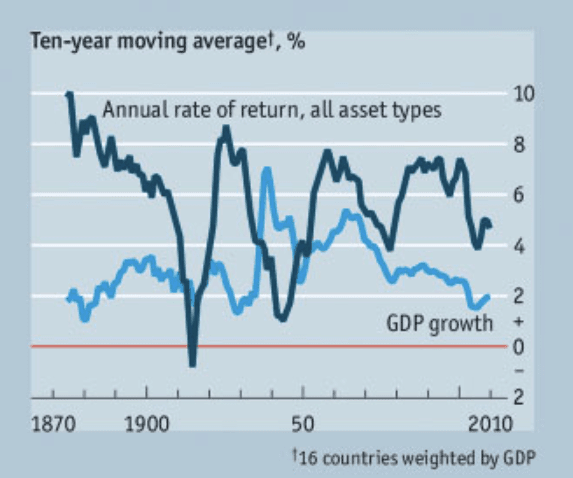

Rate of Return and GDP

Advanced economies tend to have slow economic growth over any given period of time, right? So how have returns done so much better than the GDP growth in these countries? Aside from the obvious issue that these economies looked very different in 1870 than they do today, there’s an interesting answer to this query.

It turns out the best return on investment for a country isn’t tied in a 1:1 relationship with its GDP. Over time, returns on these asset classes tend to grow on average around double the speed of the country’s economy as a whole, measured by GDP.

If anything, that “returns average double GDP growth” summary is skewed low because it includes the weak return on investment of bonds and bills. On average, the stock market and real estate market perform several times better than GDP growth.

This helps explain why income inequality tends to expand over time in advanced economies. Average Joe does not own stock investments, and if he owns any real estate, it’s his primary residence — a single-family home that he probably only earns appreciation on with no rental income (and remember, rental income makes up half of real estate investment returns!).

So, how does Average Joe improve his finances? Only through a raise. His raise is tied to how his employer is doing, which, in turn, is tied to how the economy is doing.

In other words, Average Joe’s finances are tied to GDP growth.

But Wealth-wise, Wendy, who’s not nearly as average as Joe, invests as much money as she can in the stock market and rental real estate. She builds a portfolio of passive income that earns money even while she sleeps. That income is based on the rate of return of her investments, not based on the economy.

Coupled with the impressive tax benefits enjoyed by those with an investment property? Wendy’s financial advisor undoubtedly sings her praises.

Conservatives and liberals can argue all they want about how much to redistribute wealth. But as an individual, you want to be like Wendy, not Joe. You want your wealth and income tied to the returns of the stock market and real estate investments, not tied to GDP.

Why Real Estate Investments Crush Bonds

Bonds are boring.

No, really. We already talked about how they’re low-risk, low-return. Why bother with this asset class if you can invest in rental properties, which are low-risk and high-return?

A common opinion I hear people say is, “Bonds may not have performed well over the past 15 years, but that’s abnormal! Just look at how well they did in the ’80s!”

Interestingly, this new study disproves that notion. The high bond yields of the 1980s were actually the anomaly, not the norm. In fact, if you look at bond returns over the past 145 years, there were many periods where they earned negative returns.

Want a few reasons why rental real estate offers the best return on investment compared to bonds?

Here’s a simple one: bonds expire. They pay out for a specific term, then they stop paying. Rental properties keep paying forever.

And not only do they keep paying indefinitely, but they also pay more over time. With every year that goes by, fixed bond payments become less valuable in real purchasing power due to inflation. But rental income and property value rise right alongside inflation.

It’s actually your fixed mortgage payment that goes down over time in inflation-adjusted dollars! Then one day that mortgage payment disappears, and your rental cash flow explodes.

Sure, government bonds offer stability compared to index funds, individual stocks, and even rental properties. Bonds pay the same amount every month. They never call you about a leaky roof or stop sending payments because they spent too much on cigarettes and Bud Light that month.

But at what cost in returns?

If retirement looms on the horizon for you, familiarize yourself with sequence risk and how owning rental property affects the 4 percent rule, so you don’t necessarily have to resort to bonds.

Should I Ditch Stocks and Just Buy Rentals?

Stocks may be a roller coaster, but in the long run, the good times outweigh the bad. And ultimately, finding the best return on investment requires a diversified portfolio. Stocks balance rental properties well. And when equities go down, residential real estate almost always goes up.

Real estate is illiquid compared to equities. You can buy and sell mutual funds, ETFs, or individual stocks at a moment’s notice. Investment property isn’t quite so easy to get in and out of.

Stock investing also offers truly passive income. Ultimately, rental income can never be as passive as dividend income (even with property management handling general upkeep).

It’s much easier to diversify your investment portfolio with stocks, as well. You can spread $500 across thousands of companies, in every region of the world, in every industry, and at every market cap. You’d be lucky to get away with only putting down $5,000 on a single rental property!

Is there a place for stocks in your portfolio?

Residential real estate offers excellent returns with low volatility and huge tax advantages. I love rental properties. But that doesn’t mean there’s no place for equities in your portfolio.

Stocks provide liquidity, long-term growth, easy diversification across sectors and countries, and easy investing via tax-sheltered accounts such as IRAs and 401(k)s. Real estate provides stability, a hedge against inflation, ongoing high-income yields, built-in tax advantages, and diversification from the stock market.

If you invest well, rental real estate starts performing for you immediately. Equities take longer; the stocks you buy today won’t produce significant income for you until 10, 20, or 30 years from now. But the long-term returns will compound for you at prodigious rates, and a diverse portfolio protects you from a crash in a single asset class or market segment.

Build up your retirement account with passive income from rentals and dividends, and when your peers are still working in a decade or two, their incomes tied to GDP growth, you can offer sympathetic words.

And then you can go back to playing golf and relaxing with your children, having reached financial independence.

NREIA Statement on the Biden Administration’s Recent Announcement Regarding Renters & Housing Providers

NREIA Statement on the Biden Administration’s Recent Announcement Regarding Renters & Housing Providers

(Crestview Hills, KY) The National Real Estate Investors Association issued the following statement on the Biden Administration’s recent announcement regarding renters and housing providers:

What Inflation Would Look Like in a True Free-Market Economy

by David Stockman

There is nothing more substantive than Bernanke’s original finger-in-the-air proposition that the Fed needed a 200 basis point cushion in the inflation rate in order to steer the economy clear of the dreaded 0.0% inflation line, the other side of which allegedly amounted to a black hole of deflationary demise.

But here’s the thing. There is not a shred of historical evidence that the US economy needs a 2.00% inflation guardrail to thrive, or any fixed rate of inflation at all.

For instance, even during the most difficult period of the 20th century—from 1921 to 1946 when the US economy experienced the Roaring Twenties boom, the Great Depression bust and the WWII rebound—there was abundant net economic growth over the period as a whole, accompanied by zero inflation.

In fact, the US economy nearly tripled in size during that quarter-century period. Real GDP expanded at a robust 3.64% per annum rate, and real GDP per capita rose by 2.55% per annum.

By contrast, between the 2007 pre-crisis peak and 2021, real GDP grew at only half that rate (1.72% per annum), while per capita real GDP increased by just 1.04% per year. That was just two-fifths of the rate of annual gain during 1921-1946.

Needless to say, it didn’t take any 2.00% inflationary guard rails to generate the salutary outcomes cited above for 1921-1946. The CPI index shown below posted at 542 in February 2021 and 541 a quarter century later in May 1946.

Purchasing Power of the Dollar, 1921 to 1946

![]()

As it had unfolded, there was zero CPI inflation during the Roaring Twenties; a severe deflation during the Great Depression, which merely reversed the war inflation of 1915-1920; and then a return to the 1921 price level during the booming but regimented economy of WWII.

Still, by the spring of 1946 the dollar’s purchasing power was 100% of what it had been in early 1921. It had not taken any net inflation at all to generate a near tripling of the nation’s economic output.

The implication is straightforward. To wit, the Fed doesn’t need a pro-inflation target of 2.00% per annum. Nor does it need any of its other macroeconomic targets for unemployment, jobs growth, actual versus potential GDP or the rest of the Keynesian policy apparatus. All of those variables are the job of the people interacting on the free market, producing whatever outcomes their collective actions happened to generate.

Indeed, macro-economic outcomes are not properly the business of the state at all. The Fed’s job is far more narrow. As originally conceived by its great architect, then Congressman Carter Glass, its mission was to keep the purchasing power of the dollar as good as the gold to which it was to be linked, and the banking system liquid and stable, as driven by the free market of borrowers and lenders.

As we have explained on other occasions, Congressman Glass called this a “bankers’ bank” and the term could not be more diametrically opposed to the central planners’ bank of Greenspan, Bernanke, Yellen, Powell and Brainard.

As Carter Glass saw it, no academician needed to stick his finger in the air and divine an inflation target. Nor did any modeler need to goal-seek his/her equations until they suggested the optimum U-3 unemployment rate relative to an arbitrary inflation target.

The fact is, the free market operating with sound gold-backed money was never inflationary. In that context, interest rates were also not a policy “tool” of the central bank, but the result of a market-clearing balancing of supply and demand.

As Carter Glass had arranged it, the Fed was not allowed to own government debt, nor did it have an activist arm now known as the FOMC empowered to intervene in the money and capital markets by buying and selling debt securities.

To the contrary, its avenue of operation was the discount window at the 12 regional Federal Reserve banks. The latter were authorized to advance funds to member banks, but only at a penalty spread above the free market interest rate, and also only on the basis of sound, self-liquidating collateral in the form of commercial paper that matured within a matter of months.

Given this mechanism, the dynamics of Fed policy were the opposite of today. Under the Glassian arrangement, the Fed’s balance sheet was the passive consequence of free market activity by commercial bankers and main street borrowers, not a mechanism to proactively steer the level of aggregate commerce and business activity.

Accordingly, the Fed’s value added stemmed not from wild-ass guesses about the inflation rate by PhDs like Lael Brainard, but from the grunt work of green-eyeshade accountants. Their job was to verify that bank loan collateral presented for funding at the discount window represented the obligations of sound borrowers, not speculators and high flyers, who would reliably repay under the terms of the underlying bank loan, thereby ensuring that the Fed’s discount loans would be repaid at term, too.

What this meant was that the Fed’s balance sheet was intended to reflect the ebb-and-flow of decentralized commerce and production on main street, not a centralized judgment by 12 people gathered on the banks of the Potomac about whether inflation and unemployment were too high, too low or just right.

That is to say, under the bankers’ bank arrangement the free market put an automatic check on CPI inflation. That’s because unsound speculative loans could not be easily made in the first place, since they were not eligible for discount at the Fed window.

And if demand for even sound loans got too frisky, interest rates would rise sharply, thereby rationing available savings until more of the latter could be generated or demand for the former was curtailed.

How does the FED influence the economy?

|

|

||||

|

|

||||

|

Learning From Ants

by Jeff Thomas

“If you catch 100 red fire ants as well as 100 large black ants, and put them in a jar, at first, nothing will happen. However, if you violently shake the jar and dump them back on the ground the ants will fight until they eventually kill each other. The thing is, the red ants think the black ants are the enemy and vice versa, when in reality, the real enemy is the person who shook the jar. This is exactly what’s happening in society today. Liberal vs. Conservative. Black vs. White. Pro Mask vs. Anti-Mask. Vax vs. Anti-vax. Rich vs. poor. Man vs. woman. Cop vs. citizen. [Etc.] The real question we need to be asking ourselves is who’s shaking the jar… and why?”

The above observation by Shera Starr cannot be improved upon.

And yet, the answer to the question is fairly simple.

But let’s first take a look at this anomaly. It’s natural to identify with some individuals more than others. That tendency occurred before Homo sapiens came into being. In addition, the tendency for animals to group into families or packs also predates humans.

We tend to want to be around those who behave the way we do and have the same perceptions as we do. That only makes sense. We wish to surround ourselves with those who are unlikely to surprise and possibly even endanger us by behaving in a fashion that we would not ourselves choose.

This is the basis of trust – an essential in group or herd mentality. And being a part of a group or herd brings to us increased safety.

So, what then, of those who are not within our group or herd? How do we relate to them?

Well, any nature programme that covers animals gathered around a water hole can provide that answer.

We see a small group of wild pigs drinking alongside a group of wildebeests. Neither species is predatory, so they learn to recognise that, even though one group is made up of savannah-living grazers and the other are forest-living foragers, they can easily co-exist, which will increase the ability of both species to use the water hole at the same time.

We might also see a group of hyenas using the water hole, but we notice that the prey animals all seek to keep a distance between themselves and the predatory hyenas. Everyone understands that they are all at the water hole for the same reason and it makes sense to share, even if, in another situation, they are natural enemies.

In fact, in most of nature, we see that species adapt to a condition of mutual tolerance in order to be able to coexist.

No surprise, then, that Homo sapiens got on the mutual tolerance bandwagon in its formative stages and, for the most part, has remained that way.

But it is also true that predators develop dual habits. They may exercise tolerance at the water hole, but at some point, they mean to make a meal of their water hole neighbours.

And when doing so, many species create associations with others of their kind to hunt.

This, too, is true of humans. Most of humanity seeks to live in a spirit of cooperation with others.

In the countryside, people erect walls and fences to establish boundaries, then find it expedient to respect such divisions in order to live in peace. Even in cities, people who live cheek by jowl in the same building respect each other’s privacy for the most part. Even if they do not become friends, they either remain polite or ignore each other.

Although there are always exceptions, for the most part, mankind behaves in a manner that is based upon “getting along.” He might argue with others, but for the most part, he understands that cooperation generally should be the objective, as it’s in his best interests.

But why, then, are we seeing in so many of the countries of the First World, a rapidly increasing polarity amongst people. Ms. Starr is exactly correct. Those who would be most inclined toward mutual tolerance have, in recent years, become so polarised that they cannot so much as get together with their own families for the holidays without getting into heated arguments.

Why are people of today so solidly in one of two camps?

Can this be blamed on the rise of the internet? Well, no, the internet has become the source of a plethora of opinions and perceptions. And more than closing people off to polarised “A” and “B” choices, the internet has served to broaden public discourse.

Of course, most people express distrust for the media, particularly those networks that purportedly deal in “news.” What passes for news today is far from objective information that the viewer can then assess at his leisure.

On one network, we view unceasing diatribes against one political party. Then we turn the channel and view unceasing diatribes against the opposing party.

In turning on the News, we arrive at Indoctrination Central.

But if we really pay attention objectively, we discover that the same programmes are dictating to us that it is either our humanitarian duty to vax, or that vaxxing will enslave us to globalists who will inject us with microchips.

They are also our source for the opposing beliefs that warfare is essential to protect us against those who seek to destroy us, or that it will be the wars themselves that will destroy us.

In fact, all of Ms. Starr’s concerns find their source in the media. When we ask the question, “Who is shaking the jar… and why?” we find that those who control the media are at the source of the polarisation of people, especially in the First World.

As to the “Why?” the answer is so simple that it’s often overlooked. Like the ants, the more a people can be made to fight each other, the easier it is to subjugate them.

And since the effort to polarise people has become so massive, we can only conclude that the ultimate objective will be to implement a far greater level of subjugation, in an abnormally short period of time.

Liberal vs. Conservative. Black vs. white. Man vs. woman. Divide and conquer.

In such a socio-political climate, the challenge will be to keep your wits about you. As the jar is shaken on a daily basis, it will be vital to recognise that those who control the media are creating a war between the pigs and the wildebeests. This is something that is not desired by either species, but as Hermann Goering stated, “Why, of course the people don’t want war.” They must be goaded into it if those who are pulling the stings are to achieve greater subjugation.

In the coming years, this trend can be expected to become far worse than at present. The challenge will be to escape the jar if you can. Find a location where the state of warfare is less pronounced, or if this is not possible, seek a location within the jar that’s away from the fray.

Those who fall for the bait – who buy into rabidly supporting one political party or another, or who allow themselves to be angered at an entire race, or who are conned into hatred of an entire gender – will prove to be the greatest casualties of subjugation.

This article originally posted on Doug Casey’s International Man web site.

Blog #8: Real Estate Market Fundamentals: Demographics

Many variables will influence your property investment decision when considering your options. Demographics is just one, but it has a critical role in adding value to your property portfolio through making good choices. Learn more about how demographics will influence your investment decision.

Many variables will influence your property investment decision when considering your options. Demographics is just one, but it has a critical role in adding value to your property portfolio through making good choices. Learn more about how demographics will influence your investment decision.

Demographic Factors Affecting Real Estate

Real estate demographics data are quantifiable data that analytically describe a community. A study of demographics will include age bracket, income, crime risk, school quality, employment opportunities, and population growth, all of which will impact your investment and the returns you can achieve.

Research the Real Estate Demographics Before Investing

Demographics are critical to your investment research before buying real estate because they are the next best thing to a crystal ball when predicting the future value of real estate investments in an area. For example, a location with a decreasing or increasing population is a good predictor of the future market.

Another key demographic is the crime rate. This information will give you essential insights into your prospective rental pool and the possibility of increased rental costs such as maintenance.

While we would all prefer to live in a low-crime rate area, many new investors make the mistake of overlooking this essential real estate demographic. As such, they increase their risk exposure and their ability to improve their portfolio with capital gains.

Job Growth and Real Estate Values

Research into the job market of an area is another factor to consider. If there are no employers or none are hiring, then the location is less appealing as a place to live. You may find that you can not charge the rent levels you need to create a positive income stream.

Carefully examine the employment and income data for an area, and extend your search into the surrounding areas as well. Many people are prepared to sacrifice travel time for slightly cheaper rents if the commute is reasonable.

How Amenities Can Impact Real Estate Investments

Families will search for affordable places to live by balancing rental values against easy access to good quality schools for their children. An area that is local to good schools will generally improve the value of your investment and provide a greater pool of rental possibilities.

For example, Worcester, MA, is the second largest city in New England and provides an excellent example of how educational opportunities can be a critical factor influencing the quality of an area.

Many of the suburbs around Worcester have some of the nation’s worst performing schools, with a correspondingly disappointing result in the real estate values. However, one suburb, Westwood Hills, is an exception, as the schools have a solid rating. The local real estate also achieves higher median values than the surrounding areas.

Your research into real estate demographics should seek out these anomalies as they are often less well known to other investors and, therefore, less competitive to enter.

Rental Versus Owner-Occupied Demographics

The ratio of owner-occupier versus renters real estate demographic data is another indicator that can help you achieve more value in your real estate investments.

Owner-occupiers tend to take more pride in their property’s appearance, so streets with more owner-occupied homes tend to appear well looked after and more appealing. A house on a good-looking street will generally fetch a higher price than a street full of rental stock whose landlords put little value in the property’s general appearance.

As you can see, researching a prime real estate investment can be overwhelming to investors entering the market. Fortunately, you can ensure you purchase a well-positioned property by talking to the experts who are already successful real estate investors and can help you do the same.

Blog #7: 8 Simple Ways to Supercharge Your Motivation Every Day

If you try to do something great, you’ll inevitably encounter obstacles. The more obstacles you meet, the more difficult

it is to keep your motivation at a high level. In these moments, you need techniques to fuel your motivation engine. Here are eight simple ways you can super charge your motivation:

- Focus on the things you can control.

The more you focus on things out of your control, the less motivated you’ll feel. When you focus completely on things you can control, you’ll realize that you can quickly and easily change your situation. Every day, focus on the things right in front of you. Don’t waste your time or energy on things out of your control.

- Constantly remember your purpose.

Why are you pursuing a goal or dream in the first place? What is the big, audacious purpose that motivated you to embark on the journey? More time with your family? More money? Flipping houses? To keep your motivation high, constantly keep your purpose in front of you.

- Celebrate the small wins.

It’s important to keep the big picture in front of you, but it’s also crucial to celebrate the small wins. Remember, you climb a ladder one rung at a time. You’re reaching your goal one step at a time. Celebrating the small wins will allow you to see the progress you’re making and increase your motivation levels.

- Act first, feel later.

One of the best ways to get your motivational juices flowing is to simply take action. If your goal is to read fifty books in one year, sit down and read a book for five minutes. If your goal is to flip five houses, go analyze and write five offers. It’s common for motivation to follow action. Once you take the first step, you’ll feel motivated to keep going.

- Do visualization exercises.

By visualizing your goal, you bring the future into the present. As you visualize your dream business and all the benefits it will bring, you’ll feel your present motivation skyrocketing. As you think about what it will be like to double your income, the obstacles you’re facing will melt into the background.

- Break your big goal into small goals.

Depending on your ability to focus, it might be necessary to break up the goal into segments that last anywhere from one week to 12 weeks. This way your brain can experience success and logically see a positive long-term outcome. You’ll procrastinate if the path looks too challenging.

- Repeat affirmations daily.

Affirmations help you believe that you’re going to achieve your goal. When you’re feeling overwhelmed, burned out, or low on motivation, saying things like, “I AM on my way to financial freedom,” can help you keep going.

- Surround yourself with people who motivate you.

One of the most effective ways to boost your motivation is to truly surround yourself with other people who are motivated. If you’re building a business, spend time with other passionate entrepreneurs. If you’re working toward buying rental properties, attend meetings where landlords hang out together. You need encouragement and support as you pursue your goals.

These ideas may be simple, but they’re profound. The sooner you put these to work in your own life, the soon- er you will start to see progress.

Happy Investing!

Michael Del Prete

AZREIA Executive Director

Vlog #4: Where We Invest

About House of Many Colors

House of Many Colors is owned by us, Rick and Celeste Glover. We have been actively involved in Maricopa County area real estate investing for a number of years. Our mission is to provide quality housing for quality tenants while providing an above-average return on investment (R.O.I) for our investor partners and ourselves. It is truly a win-win-win way of investing!

We offer our investor partners hands-free investment opportunities. If you are interested in learning about how to earn an above average return on your investment that is backed by a solid asset without the hassle of being a landlord, please contact Rick and Celeste.

For more information about Rick, Celeste and House of Many Colors’ investment program, please call (602) 441-3112, email celeste@houseofmanycolors.com or visit www.houseofmanycolors.com

Blog #6: Gold Vs. Real Estate: Gold Is Not a Solid Investment

Gold has been around for centuries. From ancient royalty to present-day investing gurus, plenty of people choose gold as an investment. That many people can’t be wrong, can they?

Well, as it turns out, gold may not be such a golden choice after all. On the surface, it may seem harmless, lucrative even. However, when you look closely, you might start to notice that there are a lot of reasons that gold isn’t quite the excellent investment people have believed it to be for so long.

Here is why:

A Market Steeped in Instability?

Let’s cut right to the chase. The gold market is simply not stable. That might seem strange, because most people associate gold with prestige and wealth. You figure that it is surely in high demand. Why would its price fluctuate wildly, if everyone wants it?

As it turns out, gold prices move with the economy, like any investment does.That said, gold also crashes harder than some other investments because it doesn’t really serve any purpose, at least not in the way it used to when currency was backed by it.

People like gold, but generally speaking, they don’t need it. It’s a market that people invest in when they’re afraid of paper currencies going under, but its value doesn’t come from it being useful or necessary for society.

Why Real Estate Glimmers

With that in mind, maybe gold isn’t the right investment. Its instability makes it unreliable—you can’t count on gold to weather through a tough economy with you. So, what’s another investment to consider, if you can’t count on this classic?

Let’s take a look at another thing that people have trusted as an investment for centuries: land, property, and real estate. People have been profiting from owning property for as long as there have been people. Since folks actually need places to live and work, it’s a market that’s never going to go away as long as there are humans on the planet.

Now, the real estate market does have ups and downs of its own, just like gold or any other investment. Overall, however, it’s a much more stable option. Why? Because the demand for safe housing and attractive corporate property remains constant for the most part.

Putting your money behind something necessary is a good safeguard against turbulence in the economy. You can’t always count on your coins, but real estate? Now that’s a smart investment.

Blog #5: Why Real Estate’s Equity Building Makes It a Better Long-Term Investment Than Bonds

When most people think of investing, the first things that come to mind are the intangible, particularly stocks and bonds. While many people may not understand its more complex innerworkings, most have some idea about what investing in stocks entails. But what about bonds, and are bonds sound investments, especially when compared to more tangible investments like real estate? In this article, we will consider these questions carefully.

What is a bond?

To put it simply, a bond is a type of loan whereby an investor gives money to a company, an individual or the government. In exchange, these parties promise to pay back the loan by a specific date, along with regular interest.

On one hand, bonds are typically a lower-risk investment than other more common types, especially stocks. When you buy a bond, you understand the terms and conditions from the very start and so will not likely encounter any unpleasant surprises.

That said, because they are low-risk, bonds tend to be low-yield investments unless specified otherwise. While there is usually clear risk involved, real estate often yields higher returns while also building equity.

Real estate builds equity in many ways. This could be through debt decreasing or property value increasing. In contrast, the gains you reap from bonds will be predictable and consistent but generally unremarkable. Additionally, bond returns do not respond well to inflation.

Real estate, however, is by nature dynamic. It responds to the market, which means when prices go up, so does the value of your units. When you own several apartment buildings and demand for housing in your city is on the rise, you can expect to earn more from each of your units.

In sum, the higher yield, increased stability, and long-term benefits of investing in real estate prove better and more worth your investment than bonds.

How do I invest in real estate?

There are many ways to invest in real estate. While there are intangible options like real estate investment trusts, many find it rewarding to actually manage the properties for themselves by renting them out, overseeing their maintenance, and so on.

Investing in real estate can be done through investment in rental properties or flipping property you’ve invested in. Perhaps the best way to start into real estate investment is by renting out part of a home, even if it’s just part time through a platform like Airbnb.

For more guidance, reach out today. I want to hear from you!

Vlog #3: Profit Centres

About House of Many Colors

House of Many Colors is owned by us, Rick and Celeste Glover. We have been actively involved in the Maricopa County area real estate investing for a number of years. Our mission is to provide quality housing for quality tenants, while at the same time providing an above-average return on investment (R.O.I) for our investor partners and ourselves. It is truly a win-win-win way of investing!

We offer our investor partners hands-free investment opportunities. If you are interested in learning about how to earn an above average return on your investment that is backed by a solid asset without the hassle of being a landlord, please contact Rick and Celeste.

For more information about Rick, Celeste and House of Many Colors’ investment program, please call (602) 441-3112, email celeste@houseofmanycolors.com or visit www.houseofmanycolors.com

Blog #4: Cryptocurrency vs. Real Estate: Why Government Interference May Hinder Its Profitability

Cryptocurrency has seemingly been the talk of the town for the past few years. The idea of digital currency that isn’t controlled by a central bank has intrigued many investors around the world. However, when compared to a traditional and more tangible asset like real estate, how does cryptocurrency hold up?

That question is something that we’ll come to find a clearer answer to as government interference and attention ramps up for crypto. Many assume that real estate might outpace it in the long run because of federal intervention.

In this article, we’ll be outlining what cryptocurrency is about and how its future compares to that of real estate as investing assets.

What is Cryptocurrency?

Cryptocurrency is a digital currency that is created and held electronically. Many cryptocurrencies, like Bitcoin, use things like blockchain technology to track who owns a certain amount of the currency.

The biggest difference between cryptocurrency and other more tangible currencies like the dollar is that the former isn’t controlled by a central bank. No one owns cryptocurrency by default.

Sounds like a good deal, right?

The Uncertain Future of Cryptocurrencies

Not exactly. There’s plenty of arguments you can place against cryptocurrencies being a viable investment going into the future.

The fact that it’s not tied down to a tangible asset means its value can become volatile if markets lose trust around the product. Security concerns about the storage of crypto as well as its impact on the environment are also prominent concerns.

Most importantly, government regulation of cryptocurrency seems to be on the horizon.

There’s already been talks of the SEC being involved in regulating certain cryptocurrencies because of the public discourse surrounding these types of assets. If the government gets involved, cryptos lose one of their most defining features as a decentralized asset.

But at the end of the day, distributors of cryptocurrencies would be making a bad move if they become government adversaries.

Cryptocurrency vs. Real Estate

As such, government interference can hinder the profitability of cryptocurrencies. When compared to real estate, crypto might be a less viable investment option going forward.

Real estate is tied to a tangible physical asset in land and property. It’s great for diversification and is a proven hedge against inflation. Its cash flow incentives and tax benefits also can’t go unstated.

At the end of the day, real estate is a safer investment than cryptocurrency. In terms of risk adjusted returns, real estate outperforms virtually all other assets. With questions about government interference clouding cryptocurrency’s future, some might be better off opting for real estate instead.

Answering the Question of Crypto or Real Estate

There’s absolutely nothing wrong with investing in cryptocurrency despite some questions surrounding its future. Real estate is technically the safer option now and going forward, but you can certainly reap the rewards of investing in both,

The risks of cryptocurrencies are clear. Use this article to understand those factors going forward and make high-quality investment decisions.

Blog #3: Real Estate Vs. Cryptocurrency for Inflation Resilience

Real estate has been a solid investment performer for decades and is often a great way for investors of all backgrounds to generate some meaningful income. That said, sometimes new investment trends lure some entrepreneurs. Right now, that investment trend is cryptocurrency.

Some currencies like Bitcoin saw substantial gains in 2020. This has prompted many to speculate that cryptocurrency might be the new gold standard in defense against inflation. But before you click “purchase” on Bitcoin or any of its digital look-alikes, there are a few things you should know.

The Nature of Cryptocurrency

Cryptocurrency was introduced about 12 years ago. It has no long-haul record in terms of inflation resilience. However, if there is one thing we do know about periods of dramatic inflationary increase it is that they tent to cripple unstable investments. Cryptocurrency has all the qualities of a volatile investment option.

The stability of cryptocurrency is based on its scarcity. Bitcoin for example promises not to create more than 21 million units. Unfortunately, this is not how true scarcity is derived.

There are two ways in which scarcity can be actually achieved, one it by being a limited resource such as land or gold. The other is if something cannot be replicated.

Cryptocurrency’s scarcity is not based on either of these standards. It has no physical limitations as in gold, or intellectual exclusivity as in an original work of art or a copyrighted process.

Also concerning is the minimum entry requirements to enter the online currency market. The first blockchain for cyber monies was created on a standard home computer. Since then, several companies including PayPal have been jumping onto the electric dollar bandwagon.

Because of its intangible nature, the potential value of cyber cash is impossible to predict. There are no balance sheets or income statements for investors to read, and there is a distinct lack of online currency regulations. This could be why Forbes has downgraded Bitcoin from an “investment” to a “trade” and even sees it’s further as “volatile.”

Real Estate

Real estate is actually the polar opposite of cryptocurrency when it comes to steadily weathering inflation.

Land is one thing they are not making more of. Investors can easily research neighborhood and development trends to determine which properties are on the rise. Furthermore, the housing price index shows real estate to be one of the most steadily increasing investments in the last 100 years.

If you are looking for a stable economic performer, you are better off forgoing the pixelated emoticon of a dollar sign. Put your feet and cash on real ground and embark on your journey as a real estate entrepreneur.

Vlog #2: Stable Investment

About House of Many Colors

House of Many Colors is owned by us, Rick and Celeste Glover. We have been actively involved in the Maricopa County area real estate investing for a number of years. Our mission is to provide quality housing for quality tenants, while at the same time providing an above-average return on investment (R.O.I) for our investor partners and ourselves. It is truly a win-win-win way of investing!

We offer our investor partners hands-free investment opportunities. If you are interested in learning about how to earn an above average return on your investment that is backed by a solid asset without the hassle of being a landlord, please contact Rick and Celeste.

For more information about Rick, Celeste and House of Many Colors’ investment program, please call (602) 441-3112, email celeste@houseofmanycolors.com or visit www.houseofmanycolors.com

Blog #2: Appreciate Appreciation! (or, Why Real Estate is the Real Deal)

Investors are often faced with many tempting options to place their money, often with the promise of great financial returns in the future; unfortunately, with so much information out there (including significant misinformation), ambitious investors may wonder what the “right” option is. This is especially true when it comes to mutual funds, a compelling investment choice often touted for being low maintenance and yet high-reward. But are mutual funds all that they are made out to be? In this article, we will explore that more closely.

What’s the Deal with Mutual Funds?

Mutual funds are an investment vehicle in which multiple investors pool their money, which is then directed into various stocks or other investments by a money manager.

Mutual funds seem like a decent investing option. Once you’ve chosen the fund you want to invest in, you don’t have to think too hard about what happens. It’s all fairly straightforward.

The thing is, that’s all that happens. You wait for your dividends, and then what happens? As it turns out, usually, not much. A mutual fund might appreciate monetary value and pay off—or, it might crash and burn. Look at it this way. When you invest in a mutual fund, you have a whole host of fees and charges to pay, for an investment that may or may not give you any positive return.

Why Real Estate Outshines Mutual Funds

So, how does real estate stack up to mutual funds? Well, real estate appreciates value over time. It’s a generally accepted fact of this type of investment that it will, after a few years, be worth more than you paid for it. As long as the property remains in good condition, it tends to appreciate value. This has to do with the fact that land is a finite resource. There’s only so much Earth, after all!

Mutual funds can stagnate, but real estate is an investment that you can count on. A good investment property will not only provide you with passive income while you own it (from the rent your tenants pay), but will also gain value that you’ll see when it’s time to sell.

If you’re looking to start investing in real estate, there’s no time like the present! The sooner you invest, the sooner you start seeing the potential real estate has to appreciate value and put money in your pocket. Invest smart. Invest in real estate.

Vlog #1: What Does Being Rich Mean to You?

About House of Many Colors

House of Many Colors is owned by us, Rick and Celeste Glover. We have been actively involved in Maricopa County area real estate investing for a number of years. Our mission is to provide quality housing for quality tenants while providing an above-average return on investment (R.O.I) for our investor partners and ourselves. It is truly a win-win-win way of investing!

We offer our investor partners hands-free investment opportunities. If you are interested in learning about how to earn an above average return on your investment that is backed by a solid asset without the hassle of being a landlord, please contact Rick and Celeste.

For more information about Rick, Celeste and House of Many Colors’ investment program, please call (602) 441-3112, email celeste@houseofmanycolors.com or visit www.houseofmanycolors.com

Blog #1: Real Estate vs. Bonds: Playing With Inflation

The risks and rewards of any investment depend on the nature of that investment. Each type of investment vehicle has different properties that lead to various risks—and rewards. Today, we’re going to look at the impact inflation has on bonds versus real estate: which investment benefits from the change in the value of a dollar, and which investment flops under this economic pressure?

Bonds

Bonds are a type of investment that involve the investor giving a loan to a borrower (usually a government or corporation). The investor then makes money off the bond through interest payments made on the loan’s principal, in addition to the payments received as the principal itself is paid off.

Bonds are typically considered a “low-risk” investment, but that does not mean that they are without risk. Why? Inflation. Even as the value of a currency decreases, the dollar amount that the bond is said to be worth remains the same.

So, what does that mean? Basically, as inflation increases, the value of the bond decreases. If you put in a thousand dollars, you’ll be receiving that same thousand dollars back as the bond is paid off by the recipient, even though, as time goes on, the buying power of a thousand dollars decreases.

The longer the term of the bond, the greater the negative impact inflation is likely to have on its value. Remember, inflation is, most of the time, increasing. You can’t count on a long-term bond to have your back.

Real Estate

Real estate investors, on the other hand, can find a lot of value in inflation. If a real estate investor plays their cards right, the property of inflation can inflate the value of your property.

Think of it this way. When inflation rates are high, it becomes more difficult for the average Joe to get a mortgage. That means he’s not buying a house, but he still needs a roof over his head. What does he do? He rents!

This increase in the demand for rental properties means that real estate investors can actually have a really good time during periods of high inflation, even when that same inflation is putting a strain on other types of investments, like bonds.

When you set out to invest, you have to consider the risks along with the rewards. Ballooning inflation can pop even a “low-risk” investment like a bond, but real estate can still remain afloat even in the most inflationary times. For this reason, and many others, real estate might be your best investment

option yet.